Embrace Risk Management with Cfd trading in the Forex Market

The world of finance and trading can be very sophisticated and daunting to many. However, with the proper understanding and resources, it is possible to get around your way to fiscal freedom through Cfd trading. CFD stands for “Contract for Difference” and is also a popular kind of trading from the Forex market. In this article, we shall explore the essentials of Cfd trading and just how it could pave the best way to reaching your financial objectives.

1. Comprehending Cfd trading:

Cfd trading is a kind of derivative forex market that allows dealers to speculate going up or fall of your asset’s price without having actually possessing the underlying tool. Instead, forex traders enter into a legal contract having a agent to exchange the visible difference in expense of the resource looking at the opening up to its shutting down position. Cfd trading provides several positive aspects over standard trading, like entry to worldwide markets, the capability to industry with make use of, and the opportunity of increased earnings due to the capability to short promote.

2. The Forex Market:

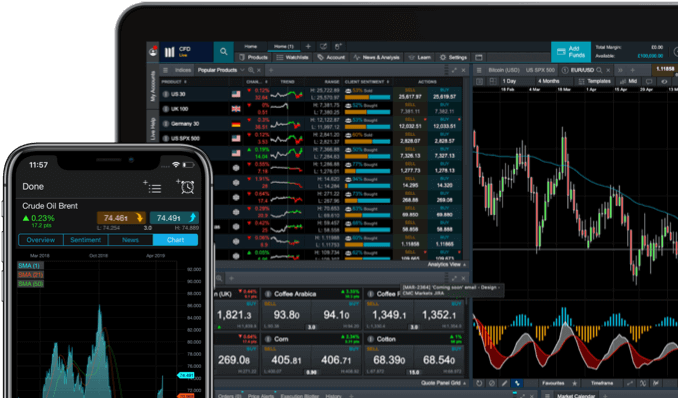

The Forex market may be the largest economic market on earth, with an average day-to-day trading number of over $5 trillion. Forex dealers can buy and sell round the clock, 5 various days and nights every week, making it a popular market for Cfd trading. The Forex market is made up of an enormous collection of currency sets, with the most popular becoming EUR/USD, GBP/USD, and USD/JPY. To start trading inside the Forex market, you need a broker that gives access to the market, trading platforms, and academic resources.

3. Selecting a Broker:

Choosing the right agent is an essential part of your Cfd trading experience. It is vital to identify a dealer that offers competitive spreads, speedy execution of transactions, reliable trading programs, and ideal customer service. Additionally, it is important to ensure that the dealer is licensed from a respected regulatory physique such as the Financial Carry out Expert (FCA), Australian Securities and Purchases Commission (ASIC), or even the Securities and Swap Payment (SEC).

4. Dealing with Your Dangers:

Cfd trading involves risks, and it is important to have a audio danger administration method in place. One particular typical method is to put into action cease-damage orders placed, which helps to lessen possible loss by automatically shutting roles if the selling price actually reaches a predetermined degree. Furthermore, investors should make certain they have a serious understanding of the market segments they trade in and restrict their being exposed to higher-risk transactions.

5. Attaining Economic Freedom:

Cfd trading can be a highly effective device in achieving monetary independence. With appropriate education and learning, a sound trading approach, along with the right broker, traders can build wealth after a while. Many people have pursued Cfd trading to generate additional sources of revenue, and several have even give up their jobs to get full time dealers. It is essential to note that success in Cfd trading calls for willpower, persistence, as well as a willingness to discover continually.

In a nutshell

Cfd trading delivers a world of opportunities for those trying to find monetary independence and self-sufficiency through Forex trading. By comprehending the fundamentals of Cfd trading, the Forex market, picking the right brokerage, handling danger, and getting a solid trading strategy, investors can achieve their economic objectives. When trading bears risks, with all the appropriate state of mind and approach, Cfd trading is an incredibly rewarding endeavor.